Embark on a journey through the realm of Health Insurance Coverage for Prescription Drugs, where the significance of insurance plans in obtaining necessary medications is unraveled. From exploring different types of coverage to understanding the impact of limited access, this topic delves deep into the intersection of healthcare and insurance.

As we navigate the complexities of healthcare access, costs, provider choices, policies, health records, and screenings, it becomes evident how crucial insurance coverage is in determining the well-being of individuals in need of prescription drugs.

Health Insurance Coverage for Prescription Drugs

Having health insurance coverage for prescription drugs is crucial for ensuring access to necessary medications for individuals. Prescription drugs can be expensive, and without insurance coverage, many people may struggle to afford the medications they need to manage their health conditions effectively.

Types of Health Insurance Plans with Prescription Drug Coverage

- Employer-Sponsored Health Insurance: Many employer-sponsored health insurance plans include coverage for prescription drugs as part of their benefits package.

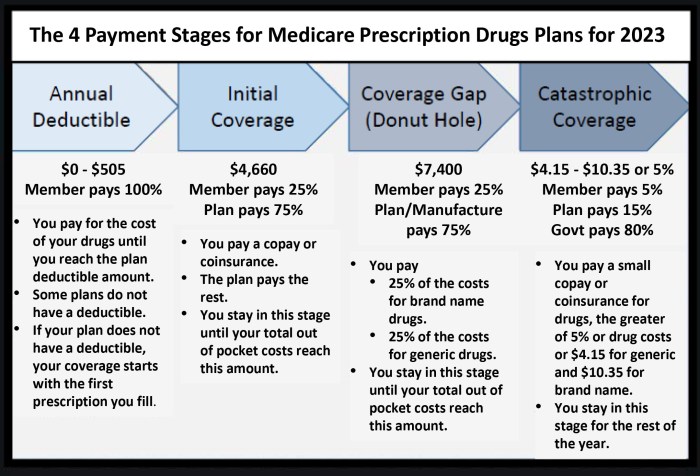

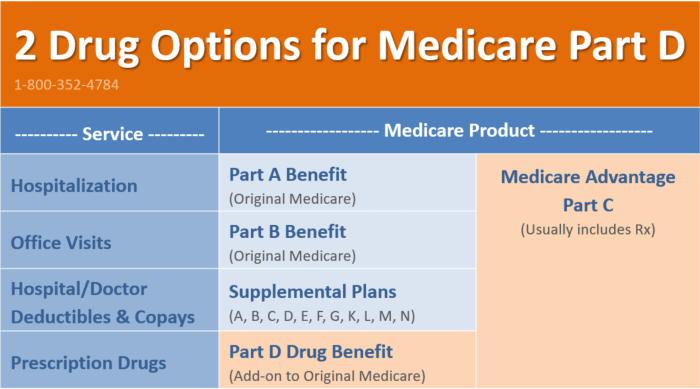

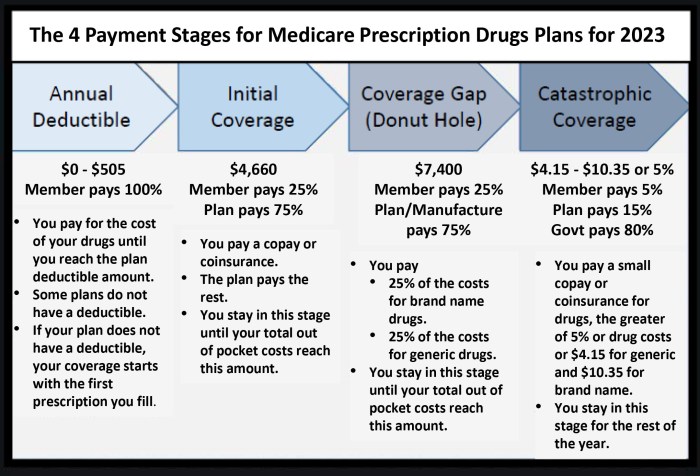

- Medicare Part D: Medicare Part D is a standalone prescription drug plan offered to Medicare beneficiaries to help cover the cost of prescription medications.

- Medicaid: State Medicaid programs also provide coverage for prescription drugs to eligible low-income individuals.

Impact of Limited or No Health Insurance Coverage

Individuals without adequate health insurance coverage for prescription drugs may face significant barriers to accessing necessary medications. This can lead to poor health outcomes, increased hospitalizations, and overall higher healthcare costs in the long run. Limited coverage or high out-of-pocket costs can force individuals to choose between paying for medications or other essential expenses, impacting their overall well-being.

Healthcare Access

Access to prescription drugs is heavily influenced by an individual’s health insurance coverage, as it determines the cost and availability of medications.

Impact of Health Insurance on Prescription Drug Access

- Individuals with comprehensive health insurance plans typically have better access to prescription medications, as these plans often cover a wide range of drugs with lower out-of-pocket costs.

- On the other hand, individuals with limited or no health insurance may face challenges in affording necessary prescription drugs, leading to delayed or inadequate treatment.

Comparison of Accessibility Across Different Insurance Types

- Private health insurance plans generally offer more extensive coverage for prescription drugs compared to government-funded plans like Medicaid or Medicare.

- Employer-sponsored health insurance often provides better access to medications than individual or marketplace plans due to lower copays and formulary options.

Barriers to Healthcare Access for Individuals without Adequate Insurance

- Uninsured individuals may struggle to afford prescription drugs at full retail prices, leading to non-adherence to treatment plans and worsening health outcomes.

- Lack of insurance coverage can result in limited choices of pharmacies and healthcare providers, further restricting access to necessary medications.

Healthcare Costs

Healthcare costs, especially for prescription drugs, can be a significant financial burden for many individuals. Health insurance coverage plays a crucial role in managing these costs and ensuring access to necessary medications. Let’s explore how health insurance coverage impacts the cost of prescription drugs and helps reduce out-of-pocket expenses.

Impact of Health Insurance Coverage on Prescription Drug Costs

Health insurance coverage can greatly affect how much individuals pay for prescription medications. Insurance plans negotiate prices with drug manufacturers, pharmacies, and other healthcare providers, often resulting in lower costs for the insured individual. Additionally, insurance plans may have formularies that list preferred drugs at lower copayments or coinsurance rates, further reducing out-of-pocket expenses.

Examples of Cost Reduction with Health Insurance

For example, a person with health insurance may only need to pay a copayment of $10 for a generic medication, while the full price without insurance could be $50. Similarly, insurance coverage can provide discounts on brand-name medications, making them more affordable for individuals. Without insurance, these costs could be significantly higher, leading to financial strain.

Financial Implications of Inadequate Health Insurance Coverage

Inadequate health insurance coverage for prescription drugs can have serious financial implications. Individuals without sufficient coverage may have to pay the full retail price for medications, which can be exorbitant. This can lead to medication non-adherence, where individuals skip doses or forgo necessary medications due to cost concerns, ultimately impacting their health outcomes and overall quality of life.

Healthcare Providers

Health insurance coverage for prescription drugs plays a significant role in determining the choices patients make when selecting healthcare providers. It can impact which pharmacies they use and which healthcare professionals they seek out for their medical needs.

Impact on Healthcare Provider Choices

When patients have health insurance coverage for prescription drugs, they are more likely to choose healthcare providers that are within their insurance network. This can affect their choice of pharmacies, as they may opt for ones that are preferred by their insurance plan to maximize benefits and minimize out-of-pocket costs.

Selection of Pharmacies and Healthcare Professionals

- Patients with different insurance plans may have varying coverage for prescription drugs, leading them to choose pharmacies that are in-network and covered by their plan to access medications at a lower cost.

- Insurance plans may also have preferred healthcare professionals or require referrals from primary care physicians for specialist visits, influencing patients’ decisions on which providers to see for their healthcare needs.

Role of Healthcare Providers in Navigating Insurance Coverage

Healthcare providers play a crucial role in helping patients navigate their insurance coverage for prescription drugs. They can assist in determining formulary coverage, prescribing generic alternatives when possible, and providing guidance on how to maximize insurance benefits for necessary medications.

Health Policies

The current health policies related to health insurance coverage for prescription drugs play a crucial role in determining individuals’ access to necessary medications. These policies Artikel the extent of coverage, co-pays, formularies, and other factors that influence how individuals can afford and obtain prescription medications.

Current Health Policy Landscape

- Health insurance plans often have varying levels of coverage for prescription drugs, with different tiers determining the cost-sharing responsibilities of individuals.

- Formularies, or lists of covered medications, can restrict access to certain drugs based on cost or perceived efficacy, leading to challenges in obtaining necessary medications.

- Certain policies may require individuals to try less expensive medications first before approving coverage for more expensive options, which can delay access to appropriate treatments.

Potential Improvements in Health Policies

- Implementing policies that ensure a broader range of medications are covered under insurance plans, including newer and more expensive drugs that may be more effective for certain conditions.

- Reducing barriers to access, such as prior authorization requirements or step therapy protocols, that delay individuals from receiving the medications prescribed by their healthcare providers.

- Exploring ways to lower out-of-pocket costs for prescription drugs, such as capping co-pays or providing subsidies for individuals with financial constraints.

Impact of Policy Changes on Affordability and Access

- Policy changes that improve coverage and reduce out-of-pocket costs can enhance individuals’ ability to afford and access prescription medications, leading to better health outcomes and improved quality of life.

- Conversely, policies that restrict coverage or increase cost-sharing may create barriers to access, forcing individuals to forego necessary medications due to financial constraints.

- By evaluating and adjusting health policies related to prescription drug coverage, policymakers can help ensure that individuals can obtain the medications they need to manage chronic conditions and stay healthy.

Health Records

Maintaining accurate health records is crucial for ensuring proper prescription drug coverage. Health records provide essential information about an individual’s medical history, current conditions, and medications, which are vital for healthcare providers and insurance companies to determine eligibility and coverage options.

Importance of Health Records for Prescription Drug Coverage

- Health records help healthcare providers assess the appropriateness of specific prescription medications based on a patient’s medical history and existing conditions.

- Insurance companies rely on health records to evaluate the necessity and effectiveness of prescription drugs, ensuring that coverage is provided for essential treatments.

- Accurate health records reduce the risk of adverse drug interactions and help prevent unnecessary or duplicate prescriptions, ultimately promoting patient safety and well-being.

Utilization of Health Records in Determining Coverage Eligibility

- Health records are used to verify the medical necessity of prescribed medications, ensuring that insurance coverage aligns with the patient’s healthcare needs.

- Insurance companies analyze health records to confirm the diagnosis, treatment plan, and medication regimen prescribed by healthcare providers, guiding coverage decisions.

- Incomplete or inaccurate health records may lead to delays or denials in prescription drug coverage approval, highlighting the importance of maintaining up-to-date medical information.

Impact of Health Records on Approval Process for Prescription Drug Coverage

- Specific health conditions documented in medical records may qualify individuals for coverage under specialized programs or insurance plans designed to address their unique healthcare needs.

- Prior authorization requirements for certain prescription drugs often involve the submission of detailed health records to demonstrate the medical necessity and appropriateness of the treatment, influencing coverage approval.

- Health records play a significant role in determining the scope of coverage, formulary restrictions, and cost-sharing arrangements for prescription medications under different insurance plans, reflecting the personalized nature of healthcare benefits.

Health Screening

Regular health screenings play a crucial role in determining coverage for prescription drugs. These screenings help healthcare providers assess your current health status, identify any potential health risks or conditions, and recommend appropriate medications or treatments, including prescription drugs.

Impact of Pre-Existing Conditions

Pre-existing conditions can significantly impact health insurance coverage for prescription medications. Insurance companies may consider these conditions when determining coverage, including the type of drugs covered, co-pays, and deductibles. Individuals with pre-existing conditions may need to provide additional medical information or meet specific criteria to access certain prescription drugs under their health insurance plan.

Relationship Between Preventive Health Screenings and Access to Prescription Drugs

Preventive health screenings play a vital role in ensuring timely access to necessary prescription drugs. By detecting health issues early through screenings, healthcare providers can intervene promptly, prescribe appropriate medications, and prevent the progression of diseases. This proactive approach not only improves health outcomes but also reduces the overall healthcare costs associated with managing advanced conditions that may require more expensive medications or treatments.

In conclusion, Health Insurance Coverage for Prescription Drugs is not merely a matter of insurance policies but a lifeline for those dependent on crucial medications. By analyzing the various facets of healthcare and insurance, we unveil the intricate web that connects individuals to their prescribed treatments.

Key Questions Answered

How does health insurance coverage impact access to prescription drugs?

Health insurance coverage plays a vital role in providing individuals with the necessary financial support to afford prescription medications, ensuring access to crucial treatments.

What are the common barriers to healthcare access related to prescription drugs?

Barriers such as limited insurance coverage, high out-of-pocket costs, and lack of prescription drug coverage in certain plans can hinder individuals from accessing necessary medications.

How can health records affect the approval process for prescription drug coverage?

Health records are used to assess eligibility for coverage of prescription medications, influencing the approval process under different insurance plans based on individual health history.